See Your Complete Retirement Picture

Connect all individual and joint accounts to one secure workspace so you and your family can make informed decisions

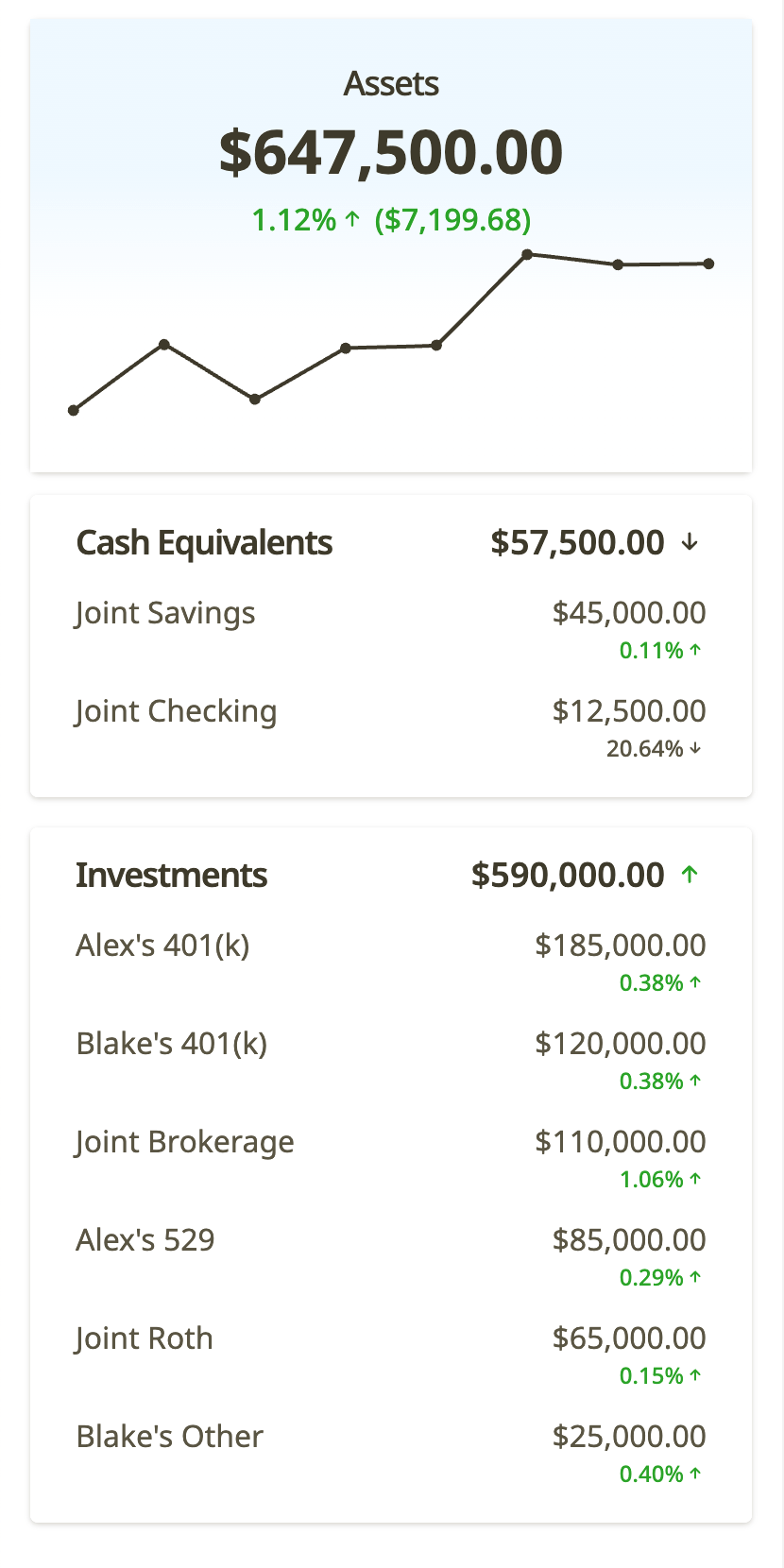

- Connect 401ks, pensions, and investment accounts automatically

- Track all income sources — including Social Security deposits and pension payments

- Give family access to specific accounts when you want their input on decisions

- See everything organized clearly instead of juggling multiple websites and statements

More Than Just Account Balances

Your retirement finances include scattered documents, beneficiary forms, passwords and professional contacts. Sabal organizes it all, then lets you decide what to share.

- Store estate documents, insurance policies, and Medicare information where family can find them

- Track account beneficiaries and ownership details so nothing gets overlooked

- Organize important passwords and notes so family isn't scrambling during emergencies

- Organize your important contacts — advisors, doctors, neighbors, family friends — with notes that add context to each relationship

Navigate Retirement Milestones

Retirement brings major decisions with deadlines - Medicare enrollment, 401k rollovers, estate planning updates. Sabal's smart checklists help you tackle these milestones with family support.

- Get started with our checklist templates or create your own

- Set up recurring financial check-ins with family that help you watch for major balance changes and transactions across accounts

- Assign tasks to family members or professionals to keep everyone on the same page

- Track progress on complex milestones like 401k rollovers or insurance updates with clear deadlines and coordination

Make the most of what you've built with family by your side

Early members get a 30-day free trial (no credit card required) and early-access pricing, plus guided onboarding to help you get the most out of Sabal.

Monthly

Yearly

$59.99

per year